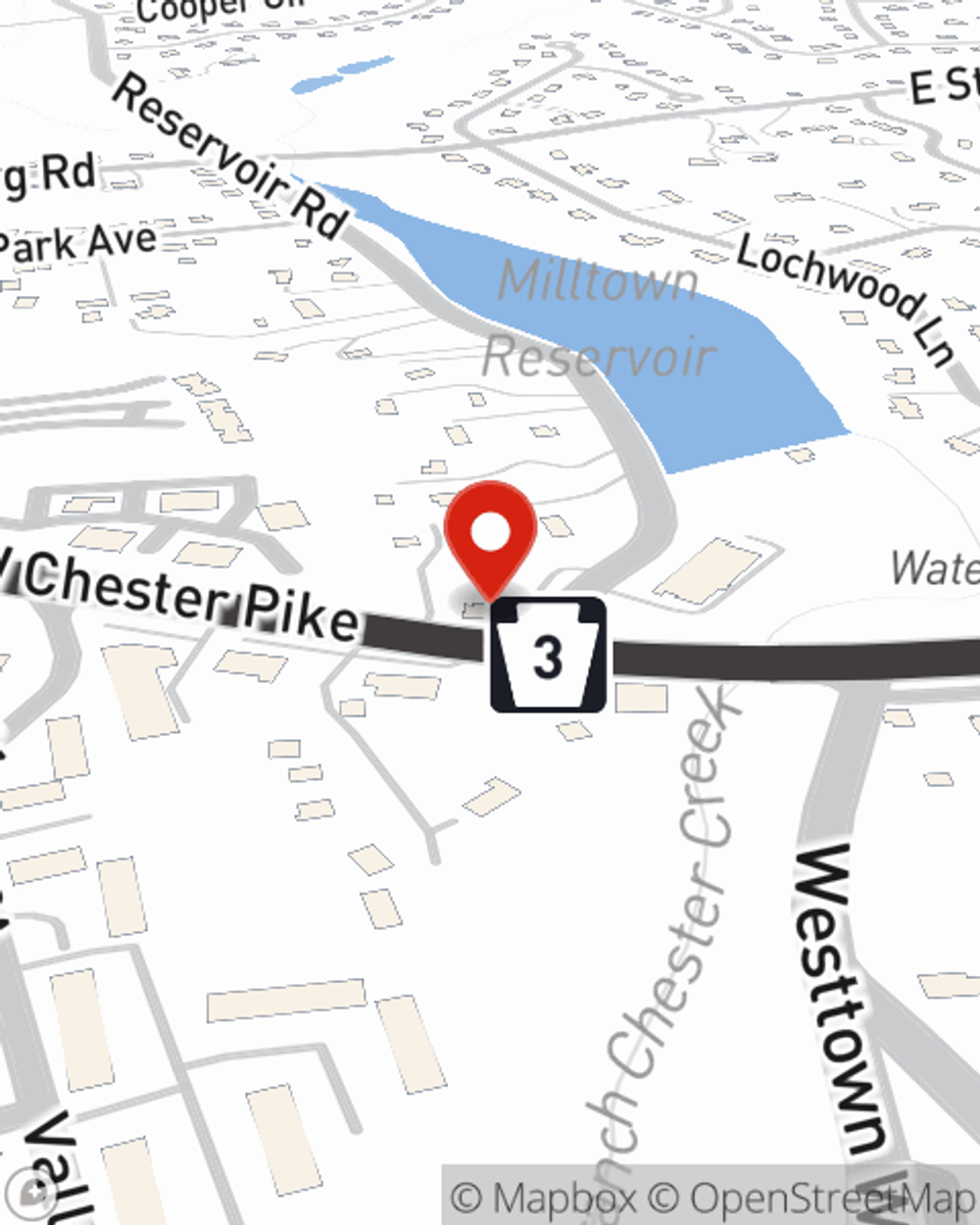

Business Insurance in and around West Chester

Get your West Chester business covered, right here!

Cover all the bases for your small business

Insure The Business You've Built.

Do you own a yogurt shop, a veterinarian or a tailoring service? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on making this adventure a success.

Get your West Chester business covered, right here!

Cover all the bases for your small business

Protect Your Future With State Farm

Your business is unique and faces a wide array of challenges. Whether you are growing an appliance store or a shoe store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Henry Nace can help with extra liability coverage as well as mobile property insurance.

The right coverages can help keep your business safe. Consider reaching out to State Farm agent Henry Nace's office today to explore your options and get started!

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Henry Nace

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.